Check IPO Allotment Status *Direct Link* Link Intime IPO, BSE IPO, IRFC IPO Status

| Check IPO Allotment Status | Linkintime IPO Allotment Status | IRFC IPO Allotment Status | BSE IPO Allotment Status | Zomato IPO Allotment Status | Nazara IPO Allotment Status | MapmyIndia IPO Allotment Status | How to check IPO Allotment Status | BSE Direct link to Check IPO Allotment Status |

If you are looking for IPO Allotment Status then you can check Status with direct link. If you have applied for the IPO Allotment then you might be curious to know about it’s status. Here we will see how you can check your IPO Status and we will discuss some of the methods which can help you to get allotment of your selected IPO.

IPO Allotment Status

| Name of the IPO | Shri Ram |

| IPO Dates | December 8-10 |

| IPO size | Rs 600 crore |

| Listing at | BSE & NSE |

| Fresh issue | Rs 250 crore |

| Price Band | Rs 113-118/share |

| Subscription | 4.6 times |

IPO Allotment status shows that particular Company’s IPO has allotted to you or not. Before that you have to apply for specific brand IPO within time frame. After that Brand allot IPO’s to the people who have applied for them. Not all people are allotted with IPO. To make it sure you have to check your IPO application status.

Here we will tell you how to Check IPO Allotment Status.

How to Check IPO Allotment Status?

Check your IPO allotment status is not a big deal. You can check your IPO Allotment status easily with direct link and for your convenience we have provided you with steps to follow IPO Allotment Status.

Step 1) Visit the official website of BSE( Bombay Stock Exchange) or click on the Direct link given here.

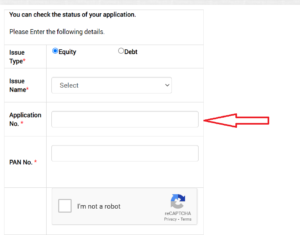

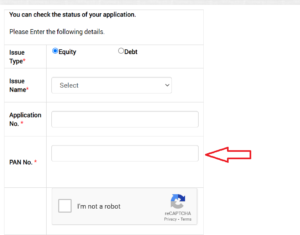

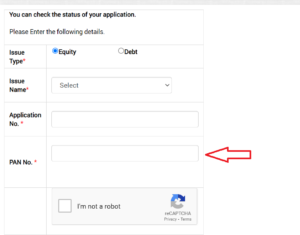

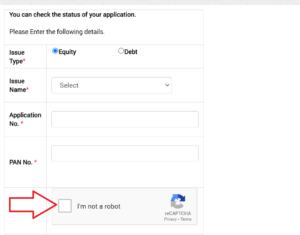

Step 2) Now select the issue type(Equity and Debt) and issue name(Name of IPO).

Step 3) Now Enter your application Number.

Step 4) Enter your PAN( Permanent Account Number)

Step 5) Now Click on I am Not Robot Button.

Step 6) After filling all the details click on submit button.

What is IPO (Initial Public Offering)?

IPO stands for Initial Public Offering. As the name suggest It is a process of transforming a private held company into a public company. The stock in this process is offer for sale to the general public by the company seeking to raise capital for expansion.

Companies come out with public issue wherein they invite public to contribute towards the equity and issue shares to meet their fund requirements by sharing ownership with investors. When one buys shares in the company ,he/she become shareholder and owner in the company by the size of share.

Types of IPO?

There are commonly two types of IPO.

Fixed price offering.

Fixed price IPO referred to as the price that some company set for the initial sale of their shares.

Basically, this is the price of stocks that the company decides to make public.

Book building offerings.

In case of a book building ,the company initiated an IPO offers a 20% price band on the stocks to the investors.

What are the advantages of investment in IPO?

- IPO allows the companies to raise capital by selling shares.

- In addition to that , companies don’t have to repay the capital raised through bidding.

- Companies can offer stock as an incentive, bonus or as a part of employment contract.

- This is sometimes use to retain key people .In addition, equity can be used to acquire other businesses as well.

What are the disadvantages of investing in IPO?

- The company needs to disclose the financial status at a regular basis as there are multiple owner of the company.

- There is no guarantee of success of your company.

- You have to afford all the expenses in the company.

- Sometimes there may be a conflict or tension between shareholders in decision making.

How to invest in IPO?

- For investing in an IPO ,an investor has to choose an IPO he wants to apply for .

- An investor can apply for an IPO through his bank account or trading account.

- The ASBA (Application Supported by Blocked Account) is mandatory for all IPO applicants .

- After all formalities, an applicant has to bid for shares.

- It is done according to the lot size which are the minimum number of shares offered by the company.

How to Check Shri Ram Properties Allotment Status?

- Open the portal of Registrar.

- Now select the Shriram Properties from the dropdown menu.

- In the next section enter your PAN Number.

- Then click on submit and check your IPO Allotment status.

How To Check MapmyIndia Allotment Status?

- Open the portal of Registrar.

- Now select the MapmyIndia from the dropdown menu.

- In the next section enter your PAN Number.

- Then click on submit and check your IPO Allotment status.

How to Check Link Intime Allotment Status?

You can check your IPO Allotment status using Link Intime. This gives the facility of tracking IPO application status using PAN, Application Number and using client id. Just follow below steps to track your IPO Status using Link in Time.

Step 1) Visit the official website of Link In Time or use the Direct Link given here.

Step 2) Now select the method using which you want to track IPO status.

Step 3) Enter PAN/ Application Number/ Client ID.

Step 4) Click on Search button.

Step 5) You IPO Allotment status will open before you.

| BSE Allotment Status | Click Here |

| Link Intime Allotment Status | Click Here |

| Read about IPO | Read More |